Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

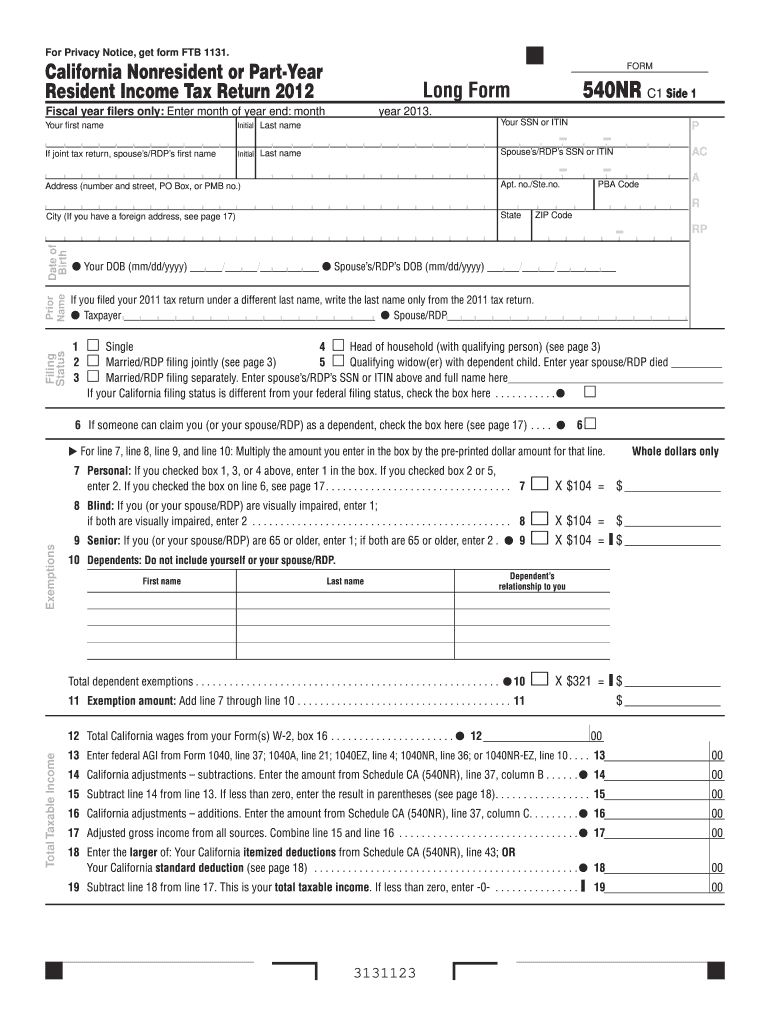

Who is required to file schedule ca 540nr?

Individuals who are required to file a California nonresident or part-year resident income tax return (Form 540NR) must file Schedule CA (540NR). This includes any nonresident or part-year resident who has income from an in-state source, such as wages, self-employment income, rental income, or other income from a business or profession that is taxed in California.

What is schedule ca 540nr?

Schedule CA (Form 540NR) is used by non-residents and part-year residents of California to determine their California adjusted gross income and calculate their California income tax.

This form helps individuals report any income received from California sources, such as wages, business income, rental income, and investment income. It also allows taxpayers to claim deductions, credits, and exemptions specific to California taxes.

Schedule CA 540NR is filed as an attachment to Form 540NR, the California Nonresident or Part-Year Resident Income Tax Return. It is used to provide additional detailed information and calculations related to the taxpayer's California tax liabilities.

What is the purpose of schedule ca 540nr?

Schedule CA 540NR is used to report various adjustments to income and adjustments to tax for nonresidents or part-year residents of California. This form is specifically designed for individuals who are not California residents for the entire tax year or for individuals who are residents for only a portion of the tax year. The purpose of Schedule CA 540NR is to calculate the correct amount of California taxable income and determine the correct California tax liability for these individuals. It helps to reconcile the differences between federal and California tax laws and ensure accurate reporting of income and taxes for California nonresidents and part-year residents.

When is the deadline to file schedule ca 540nr in 2023?

The deadline to file Schedule CA 540NR in 2023 would typically be April 15th. However, it is advisable to check with the California Franchise Tax Board or consult a tax professional for the most accurate and up-to-date information regarding tax deadlines.

How to fill out schedule ca 540nr?

Filling out Schedule CA 540NR requires information from your California state income tax return (Form 540NR). The form is used to report adjustments to your income and deductions for California tax purposes. Here are the steps to complete Schedule CA 540NR:

1. Gather your tax documents: Before starting, collect your Form 540NR and any supporting documents such as W-2s, 1099s, etc.

2. Begin with Part I: Income Adjustments:

a. Follow the instructions on Schedule CA 540NR to report adjustments to your federal adjusted gross income (AGI) for California state tax purposes.

b. Enter the adjustment amounts in the appropriate lines of Part I based on the guidelines provided on Schedule CA 540NR.

3. Move to Part II: Use Tax and Other Taxes:

a. Enter any necessary information related to use tax or other taxes reported on Form 540NR.

b. If you owe use tax, calculate it based on your purchases made without paying California sales tax and enter it appropriately on the form.

4. Proceed to Part III: Underpayment of Estimated Tax:

a. Determine if you are subject to the underpayment of estimated tax penalty by referring to the instructions on Schedule CA 540NR.

b. If you are subject to the penalty, calculate it using the provided guidelines and complete the required lines on the form.

5. Continue to Part IV: Other Payments and Credits:

a. Report any additional payments or credits you may be eligible for, such as other state taxes paid and/or credits from prior year overpayments.

b. Follow the instructions on Schedule CA 540NR to accurately report these payments or credits.

6. Review the completed Schedule CA 540NR: After filling out all the required parts, go through the form carefully to ensure accuracy and make any necessary corrections.

7. Attach Schedule CA 540NR to your California state income tax return (Form 540NR): Once you have completed Schedule CA 540NR, attach it to the Form 540NR when filing your state income tax return.

Note: This is a general guide, and it is always recommended to consult the official instructions provided by the California Franchise Tax Board (FTB) for specific details related to your tax situation.

What is the penalty for the late filing of schedule ca 540nr?

The penalty for late filing of Schedule CA 540NR depends on the total tax amount owed and the duration of the delay. The following penalties apply:

1. Late Filing Penalty: If you fail to file your Schedule CA 540NR by the due date, you will be charged a penalty of 5% of the additional taxes owed for each month or partial month the return is late, up to a maximum of 25%.

2. Late Payment Penalty: If you fail to pay the full amount of tax owed by the due date, you will be charged a penalty of 0.5% of the unpaid tax for each month or partial month the tax remains unpaid, up to a maximum of 25%.

3. Failure to File Penalty: If your return is filed over 60 days late, the minimum penalty will be $135 or 100% of the tax owed, whichever is less.

It's important to note that interest will also be charged on any late payments or unpaid taxes. The interest rate is determined by the Franchise Tax Board and is subject to change annually.

What information must be reported on schedule ca 540nr?

Schedule CA (540NR) of the California Nonresident or Part-Year Resident Income Tax Return (Form 540NR) is used to report various deductions, adjustments, and credits for nonresidents or part-year residents of California. Here are some of the common types of information that must be reported on Schedule CA (540NR):

1. Federal Adjustments: Any adjustments made on your federal income tax return that do not affect California taxable income need to be reported.

2. Income Adjustments: Any adjustments to your gross income made for California purposes, such as California lottery or gambling winnings.

3. Renters Credit: If you are eligible for the California Renter's Credit, you need to report the amount claimed on Schedule CA (540NR). This credit is available for part-year residents and nonresidents who pay rent.

4. Additional Taxes: Certain additional taxes paid, such as the California Mental Health Services Tax or Insurance Tax, need to be reported on Schedule CA (540NR).

5. Contributions: If you made certain charitable contributions or contributed to a College Access Tax Credit Fund, you need to report these on Schedule CA (540NR).

6. Other Deductions: Any other deductions that are allowed on California income tax return, such as alimony paid, pass-through entity adjustments, or educator expenses, need to be reported on Schedule CA (540NR).

7. Credits: Certain tax credits, such as the Child and Dependent Care Expenses Credit, the California Earned Income Tax Credit, or the Credit for Taxes Paid to Other States or Countries, need to be reported on Schedule CA (540NR).

It is important to carefully review the instructions and requirements specific to your tax situation and consult a tax professional if you are unsure about any details.

How can I get schedule ca 540nr?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the schedule ca 540nr 2023 form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out ca540nr using my mobile device?

Use the pdfFiller mobile app to complete and sign form 540nr schedule ca on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out 2023 schedule ca 540nr on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your california schedule ca 540nr form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.